July '25 SpaceX Intelligence

Space Economy’s 2024 Spend Reaches $600 B; SpaceX Worth $400 B, and Trump-Musk Feud Continues

A Quick Heads-Up Before You Dive In

This is the last edition you’ll receive via Beehiiv. Starting next week, we’re switching to a weekly cadence and sending each digest directly from our own platform.

What’s changing?

Frequency & Scope: From monthly to every Tuesday: a concise wrap-up of the week’s top space-sector news, with expanded coverage beyond SpaceX.

Depth: One-click access to our weekly deep-dive analyses; click straight from your inbox to the full articles, datasets, and charts on our research platform.

Nothing extra required: You’re already on the list; the sender name will simply change.

We’re excited to deliver fresher insights, faster. See you in your inbox next week!

Now, let’s dive into the July recap…

Combined commercial revenues and government outlays in the space sector topped $600 billion in 2024.

Trump threatened to deport Musk and cut SpaceX contracts over GOP bill criticism, but a federal review later confirmed SpaceX’s work is too vital to halt.

Starlink surpassed six million users, hit 113,000 kits per week, and added 2.7 Tbps per V2 Mini batch, pushing toward $12B in 2025 revenue. SpaceX reached a $400B valuation, committed $2B to xAI, and ramped up AI deployment across operations as Musk returned to hands-on leadership.

Rivals like Kuiper and Eutelsat gained ground, but with record launch cadence, global reach, and AI-fueled manufacturing, the market still orbits SpaceX.

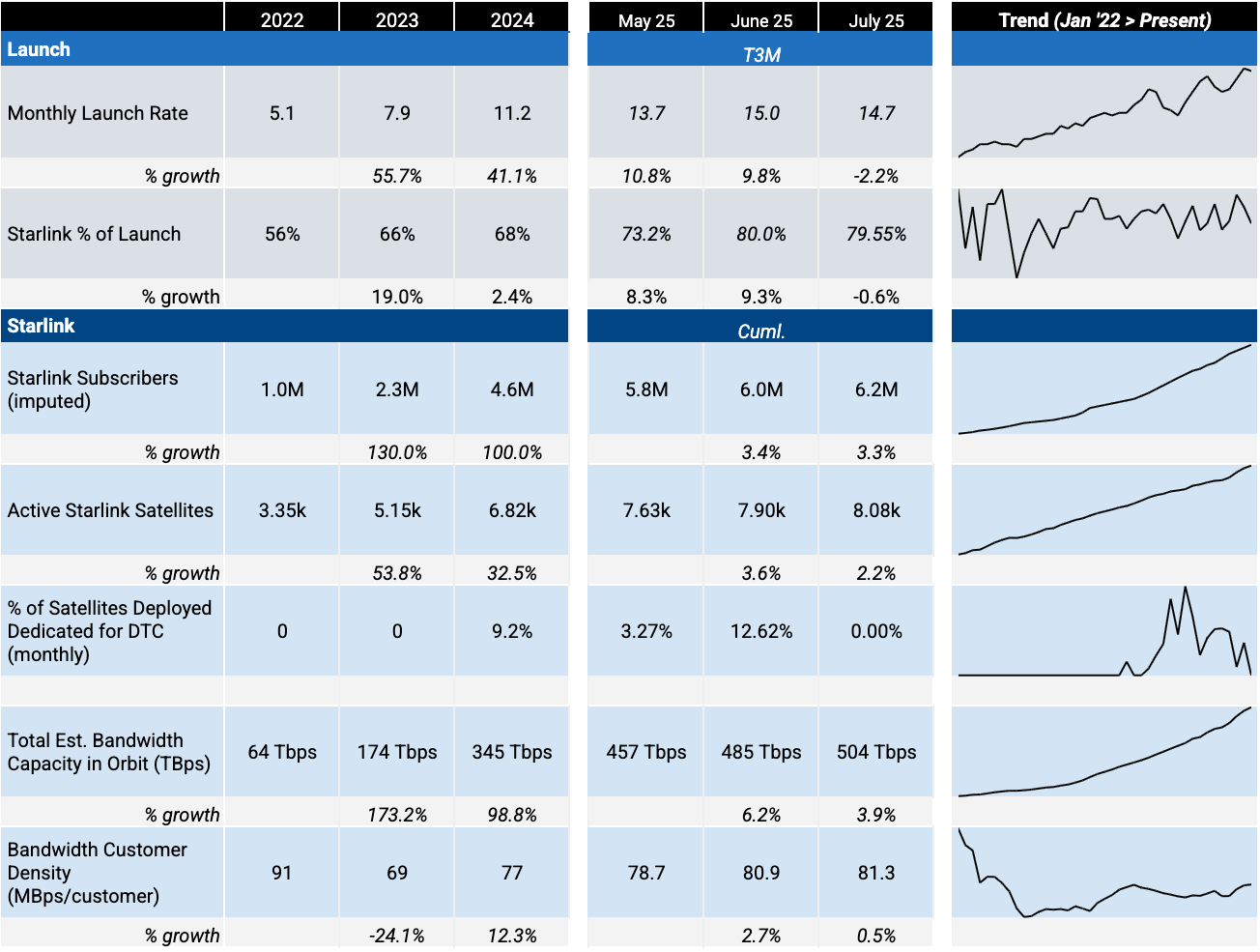

KPI Dashboard

🚀 Back the Companies Building Humanity’s Future

Mach33 has placed $34M over the past two years into leading space and frontier technology companies, from secondaries in industry leaders to early bets on breakthrough tech.

We’re backing the teams shaping the next frontier, join us!

July News Roundup

July 1

Trump Threatens Deportation as Musk Renews Attack on GOP Spending Bill

President Donald Trump said he would “look” at deporting Musk and using the Department of Government Efficiency (DOGE) against him after the SpaceX and Tesla chief again blasted the “One Big Beautiful Bill,” a Republican tax-and-spending package projected to swell the U.S. deficit by trillions. Trump accused Musk of opposing the legislation only because it scraps electric-vehicle targets and “subsidies,” warning that the billionaire could “lose a lot more than that,” including federal contracts vital to SpaceX’s launch business. Musk, who stepped away from an advisory role at DOGE in May, countered that the bill would wipe out the savings his cost-cutting program claimed and vowed to bankroll primary challenges—or even start a new party—against supporters of the measure. While the feud highlights political risk around major aerospace contracts, SpaceX’s strong manifest and NASA’s reliance on Starship suggest commercial launch momentum should remain intact.

July 4

Internal Post Shows Starlink Factory Output Tops 113 000 Kits per Week

Independent X analyst (@xdnibor) flagged a now-deleted June 13 image from SpaceX’s internal tracker indicating Starlink hardware production has reached about 113 000 user-terminal kits per week—roughly 16 000 per day. At that cadence the Bastrop and Hawthorne lines can turn out nearly six million dishes a year, a rate that aligns with SpaceX’s separate announcement the same day that it had built its ten-millionth kit overall. Volume manufacturing lets the company cut retail prices, as shown by July’s limited-time discount on the new portable “Mini” terminal, while still supporting rising demand from fixed broadband, maritime and direct-to-cell customers. Sustained high-throughput output underpins forecasts that Starlink revenue could pass US $12 billion in 2025 and gives SpaceX a stable cash engine for its Starship and lunar-lander programs.

July 8

SpaceX Targets $400 B Valuation in New Internal Share Sale

TechCrunch reports that SpaceX is arranging a fresh fundraising round paired with an employee tender offer that could lift the company’s valuation from roughly $350 billion to about $400 billion. Sources say the deal would involve selling new shares mainly to existing insiders, a structure that has kept dilution low in prior rounds. Management argues the higher price reflects booming Starlink revenue and steady progress toward fully reusable Starship operations. A successful raise would hand the firm additional capital for satellite expansion and rapid-fire Starship tests, reinforcing investor belief that SpaceX can keep compounding growth.

July 9

Starlink V2 Mini Each Adds 2.7 Tbps to Network

A SpaceX post revealed that every Starlink V2 Mini batch boosts constellation capacity by roughly 2.7 terabits per second, enabling higher speeds and more users. At the current launch tempo of three to four flights per week, that equates to roughly 10 Tbps of fresh bandwidth monthly. The steady throughput gains underpin optimistic revenue forecasts that see Starlink topping $12 billion next year while still dropping terminal prices.

July 10

Sean Duffy appointed acting NASA administrator during budget negotiations

President Trump named Transportation Secretary Sean Duffy as interim head of NASA after withdrawing the previous nominee in May. Reuters reports that Duffy will guide the agency through an appropriations cycle that includes proposed workforce reductions while maintaining Commercial Crew and Artemis timelines. His Capitol Hill experience is expected to help secure steady funding for lunar lander milestones and science missions. Industry observers see the appointment as short-term political cover that still keeps NASA’s major commercial partnerships on track.

July 10

UK and France deliver €1.5 B recapitalisation for Eutelsat/OneWeb

Britain confirmed a €163.3 million investment that preserves its 10.9 % “golden-share” stake in Eutelsat, joining a larger French cash injection to bring the rescue package to €1.5 billion. The money will accelerate OneWeb Gen-2 deployment and help the operator bid for Europe’s secure IRIS² constellation. Shares jumped as much as 10 %, reflecting market belief that government backing positions Eutelsat as a credible low-Earth-orbit alternative to Starlink. The recapitalisation also stabilises Europe’s second-largest satellite fleet ahead of expected demand from defence and mobility customers.

July 12

White House Directs Review of SpaceX Contracts Amid Musk–Trump Rift

Wall Street Journal reports that SpaceX will commit $2 billion to Elon Musk’s AI venture xAI as part of a larger $5 billion equity raise aimed at scaling the Grok model family. The deal deepens cross-company ties while avoiding dilution at SpaceX, whose valuation is already pushing $400 billion. Analysts view the move as a low-risk way for SpaceX to monetise its cash flow and data assets while gaining exposure to a fast-growing AI platform that could enhance autonomous navigation and satellite-network optimisation. The funding vote has boosted expectations that Musk’s firms will continue to share technology without formal mergers.

July 16

SpaceX Launches Amazon’s Kuiper Satellites

A Falcon 9 lifted off from Cape Canaveral at 02:30 ET, deploying 24 Project Kuiper spacecraft on mission KF-01. The launch demonstrates SpaceX’s open-access model by carrying payloads for its largest broadband rival while continuing its own Starlink cadence. Booster B1096 landed on the droneship “A Shortfall of Gravitas,” marking SpaceX’s 476th successful recovery. Amazon said the satellites bring its constellation to 78 and keep FCC deployment milestones on track.

July 17

Vietnam Greenlights Starlink Pilot Launch

Deputy Science Minister Pham Duc Long said Vietnam will license a controlled Starlink pilot in the fourth quarter of 2025 once SpaceX completes local incorporation and ground-station approvals. The trial will open one of Southeast Asia’s largest untapped broadband markets, covering roughly 25 million unserved households. Regulators have set an initial pilot period through 2030 with no foreign-ownership cap, signalling Hanoi’s bid to attract U.S. tech investment.

July 18

Starbase safety metrics improve, but still exceed national average

TechCrunch’s review of OSHA filings shows Starbase logged 4.27 recordable injuries per 100 workers in 2024, roughly triple the aerospace-manufacturing average and the highest of SpaceX’s land facilities. The rate, however, has fallen from 5.9 in 2023. NASA says it continues to seek a safer SpaceX work culture and production process. Further reductions would ease schedule risk for Starship and improve the site’s appeal to investors and skilled workers.

July 19

Trump Administration Review Confirms SpaceX Contracts Too Critical to Cut

An internal review initiated under President Trump evaluated SpaceX’s federal contracts following a political fallout with Elon Musk, finding that the company remains indispensable to U.S. government operations. The investigation, prompted by Musk’s criticism of Trump’s economic policies, confirmed that terminating SpaceX agreements would disproportionately disrupt NASA and DoD programs. SpaceX continues to secure multi-billion-dollar defense and commercial contracts amid political scrutiny.

July 19

Blue Origin’s New Glenn to Launch Twin ESCAPADE Mars Probes

Blue Origin announced that its partially reusable New Glenn rocket will carry the twin ESCAPADE probes on its NG-2 mission, targeted no earlier than August 15, from Cape Canaveral. ESCAPADE will study how the solar wind strips the Martian atmosphere, using two identical spacecraft built by Rocket Lab. The assignment gives New Glenn its first interplanetary payload and a chance to demonstrate booster recovery after the vehicle’s successful but expendable debut in January. Securing a NASA science mission adds momentum to Blue Origin’s push for a competitive heavy-lift option alongside Falcon Heavy and forthcoming Starship flights.

July 19

Senate Bill Shields NASA Science Portfolio from Deep Cuts With One Notable Exception

The Senate Appropriations Committee’s draft FY 2026 Commerce-Justice-Science bill restores nearly all of the $3.4 billion in science cuts proposed by the White House, keeping NASA’s science account at roughly $7.3 billion and directing continued operations for flagship observatories such as Chandra, MAVEN and Terra. Report language lists more than 30 Earth-and-planetary science missions slated for termination that must now be funded through at least next year, and it urges NASA to honor international commitments on projects like ESA’s LISA and ExoMars. Lawmakers explicitly defer a decision on the over-budget Mars Sample Return program but insist any future cancellation be driven by peer review, not budget pressure. If the bill was enacted, the measure would avert layoffs and sustain a broad research pipeline, signaling bipartisan confidence in NASA’s scientific return on investment.

July 20

Musk Doubles Down on AI Integration and Hands-On Leadership at SpaceX

Elon Musk wrote on X that he is “game on” for embedding generative AI across all SpaceX operations after previously taking a cautious stance. He said he is “back to working 7 days a week and sleeping in the factory,” echoing the 120-hour workweeks he logged during Tesla’s Model 3 ramp-up. Internal teams told TOI the first Grok-based tools are already flagging weld defects and spotting anomalies in Raptor test-fire data, cutting review cycles by hours. Musk’s renewed round-the-clock presence and green-light for AI are expected to accelerate Starship production and Starlink network optimisation, reinforcing confidence in SpaceX’s aggressive cadence targets.

July 23

Pentagon broadens Golden Dome bidding beyond SpaceX

Reuters reports that the POTUS' administration has asked Amazon’s Project Kuiper, major defense primes and several launch startups to submit proposals for Golden Dome, the $175 billion missile-tracking satellite network previously expected to lean heavily on SpaceX. Officials say spreading contracts will reduce political and supply-chain risk while speeding deployment of the 600-plus spacecraft constellation. SpaceX remains a front-runner for high-cadence launches, but diversified sourcing could drive competition, lower costs and harden the system against single-vendor delays especially “amidst a deteriorating relationship between Trump and Musk.” Broader industry participation would also enlarge the U.S. space-industrial base, a net positive for innovation and fiscal resilience.

July 23

Global space economy tops $600 billion for the first time

The Space Foundation’s latest Space Report pegs the 2024 space economy at $613 billion, a 7.8 percent year-on-year jump driven by commercial launch frequency and rising government security budgets. Commercial activity now accounts for 78 percent of the total, reflecting robust demand for broadband, imagery and in-orbit services. Analysts project the market could hit $1 trillion by 2032 if current compound growth rates hold, signaling investor confidence that lowering launch costs and diversified revenue streams are fueling durable expansion.

July 25

Starlink Restores Service After Rare 2.5-Hour Global Outage

SpaceX’s Starlink network went dark for roughly 2 ½ hours on Thursday afternoon, cutting off tens of thousands of users worldwide. Company engineers traced the disruption to “failure of key internal software services” and rolled back the change; normal traffic resumed before sunset. Elon Musk apologised publicly and said the team is “remedying root cause to ensure it doesn’t happen again.” Despite the hiccup, Starlink’s rapid diagnosis and recovery are indicative of the resilience of a system that now carries broadband for more than six million customers across 140 countries.

July 28

Nearly 4,000 NASA Employees Accept Voluntary Buyouts

NASA confirmed that about 3,870 staff, roughly 20 percent of its workforce, have opted for early-retirement and buyout packages aimed at restructuring the agency. Officials stressed that critical mission areas will be back-filled and said the departures open room for fresh talent in AI, autonomy and commercial-station oversight. Analysts note the move could trim overhead while preserving funds for flagship science and Artemis exploration budgets. The agency will retain approximately 14,000 employees after the transition, still far larger than any other civil-space organisation.

July 28

Firefly Aerospace Files for Nasdaq IPO at $5.5 B Valuation

Firefly Aerospace’s S-1 shows a target raise of up to $632 million, with shares priced between $35 and $39, giving the Texas launch and lunar-lander firm a potential market cap of $5.5 billion. Proceeds will fund additional Alpha rocket flights and scale production of the Blue Ghost lunar landers after March’s successful moon touchdown. Bankers cite improved market sentiment and strong defense demand for responsive launch as tailwinds. The listing would be the first U.S. space-pure-play IPO since Rocket Lab in 2021, signaling renewed investor appetite for the sector.

Eye Candy

Falcon 9 en route to deliver Starlink satellites from Cape Canaveral

Astronaut, Navy SEAL, medical doctor, naval aviator, and flight surgeon Jonny Kim poses with Axiom director of human spaceflight Peggy Whitson on the ISS cancer research laboratory module

Stay Updated with SpaceX News

Subscribe to our monthly newsletter for the latest SpaceX updates, analysis, and insights delivered straight to your inbox.